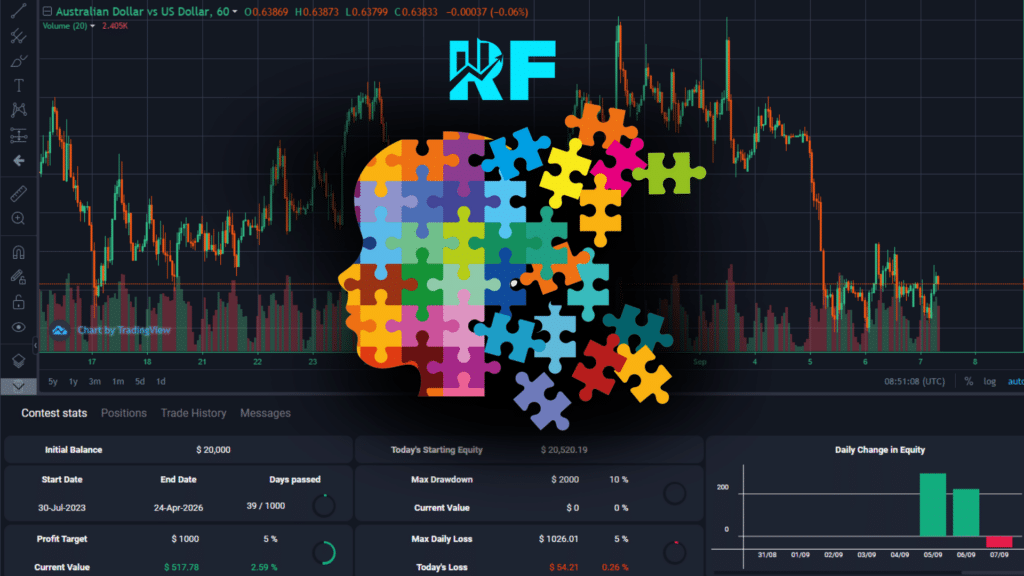

14 Cognitive Biases that can Prevent Consistent Trading Profits

Forex trading is a venture that requires an analytical mind. It requires the ability to make rational decisions. But unfortunately, our brains are not always completely rational or objective when trading. Cognitive biases contribute to our occasional subjectivity.

Cognitive biases are mental shortcuts that can influence our decision-making process. It often leads us astray in our trading activities. By understanding and recognizing them, we can improve our trading performance.

In today’s blog post, we will look at fourteen cognitive biases that can affect our trading performance, and also provide strategies to mitigate their influence:

1. Overconfidence Bias

Overconfidence bias occurs when traders overestimate their knowledge or have an inflated belief in their skills. This usually leads them to take excessive risks. Although confidence is useful in forex trading, overconfidence can result in overtrading, impulsive trading decisions, and substantial losses. To combat overconfidence, regularly assess your trading strategies objectively, challenge your assumptions by looking at them from different angles, and maybe seek feedback from others.

2. Confirmation Bias

Confirmation bias is very common in trading. It is the tendency to seek out and interpret information that confirms our existing beliefs. Traders afflicted by this bias may ignore warning signs. They may tend to focus only on data that supports their trade thesis or information that aligns with their existing beliefs. To overcome this bias in your trading activities, you must actively seek opposing viewpoints. Conduct thorough research to understand the broader market dynamics.

3. Loss Aversion

Loss aversion leads traders to prefer avoiding losses over making gains. We feel the pain of losses more intensely than the pleasure of gains. Our decisions start being driven by fear of losing. This causes us to hold onto losing positions for too long. We become reluctant to exit losing trades, hoping for a reversal. As a result, we put our funds in danger, and also miss profitable opportunities. To overcome loss aversion, we must establish clear stop-loss orders and adhere to them diligently.

4. Anchoring Bias

Anchoring bias occurs when traders fixate on specific prices or values, making it difficult to adapt to changing market conditions. For example, if we see a currency pair reach a specific price level, we may anchor our expectations and base our future trading decisions on that level (even if the market dynamics have since changed). To mitigate anchoring bias, continually reassess your trading decisions and avoid being overly attached to initial price targets.

5. Hindsight Bias

Hindsight bias (also known as the “I knew it all along” phenomenon) is a cognitive bias that causes us to believe that we could have predicted an event’s outcome accurately after it has occurred. It makes us feel like a god. It often leads us to overestimate our ability to predict the market and underestimate the role of uncertainty and randomness. It can lead to overconfidence and reckless trading. Prevent hindsight bias by keeping detailed trading journals and analyzing past decisions objectively.

6. Availability Heuristic

The availability heuristic causes traders to rely on readily available information, often ignoring less accessible but equally important data. Combat this bias by using a comprehensive approach to market research and analysis.

7. Self-Attribution Bias

Self-attribution bias leads traders to credit themselves for successful trades while attributing losses to external factors. Maintain a realistic self-assessment and acknowledge the role of luck in trading outcomes.

8. Herd Mentality

Herd mentality is the tendency to follow the crowd, even if it contradicts your own analysis. Avoid this bias by developing a well-defined trading strategy and sticking to it, regardless of popular sentiment.

9. Recency Bias

Recency bias occurs when recent events have an outsized impact on decision-making. We overreact to recent market movements. For example, if a currency pair has been consistently moving in one direction for the past few days, traders may assume that the trend will continue indefinitely, leading them to enter trades based solely on this recent movement. To beat this bias, ensure your trading strategies are based on a broad range of historical data, not just recent trends.

10. Gambler’s Fallacy

The gambler’s fallacy involves believing that past outcomes influence future probabilities (even when each event is independent and unrelated). Forex traders affected by the gambler’s fallacy may believe that if a currency pair has been continually moving in a particular direction, it is more likely to reverse in the opposite direction in the next trade. To overcome this, develop a trading plan based on sound analysis rather than relying on the idea that a losing streak is bound to change.

11. Endowment Effect

The endowment effect causes traders to overvalue the assets they own. It leads us to hold onto losing positions. Combat this bias by setting predefined exit points and sticking to them.

12. Regret Aversion

Regret aversion can make traders hesitant to make necessary changes (due to fear of regret). To overcome this bias, be willing to accept mistakes. Also, adapt your trading strategies as needed.

13. Cognitive Dissonance

Cognitive dissonance occurs when traders justify poor decisions to reduce psychological discomfort. Stay objective and avoid making excuses for poor trading choices.

14. Anchoring to Past Prices

Anchoring to past prices makes it challenging to adjust trade entry and exit points. Focus on current market conditions and avoid being overly influenced by past prices.

Cognitive biases are a part of human nature, but in trading, they can lead to costly mistakes. So, it is important to recognize these biases and actively work to counteract their influence. This is crucial for successful trading. Develop a disciplined approach, keep detailed records, seek diverse perspectives, and continually refine your strategies. By doing these things, you can navigate the financial markets with greater objectivity and improve your overall trading performance.