Funded Account Challenge: Esther’s Journey from Near Loss to $160,000 Victory – A Brief Interview

Meet Esther, a trader whose journey through the RebelsFunding program is a testament to resilience, determination, and unwavering ambition.

Esther’s story is a captivating narrative of near defeat transformed into a resounding victory.

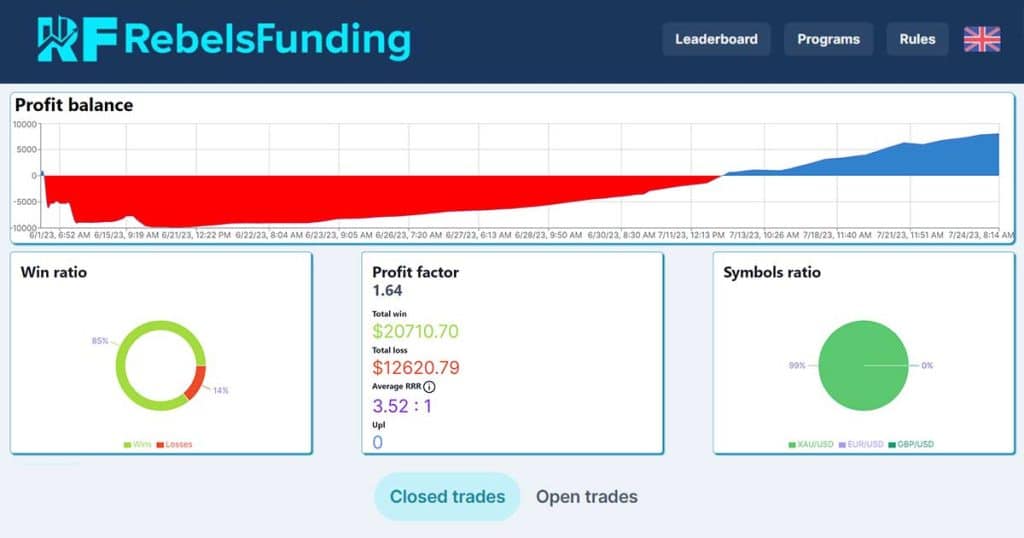

Just a few dollars away from violating the 10% maximum total drawdown rule, she managed to defy the odds and become a funded account trader at RebelsFunding.

As we explore her experience (via a brief interview), we’ll touch pivotal moments that led her to question, strategize, and overcome.

Let’s have a chat with her:

Interviewer: Winning a funded account from RebelsFunding is a great achievement. How does it feel to have $160,000 at your disposal for trading?

Esther: As a trader, it’s a beautiful feeling to have more trading capital. I have now gone from managing N125,000 ($140) to managing N144,000,000 ($160,000)!

It’s a life-changing experience for me.

Interviewer: Can you tell us about the initial challenges you faced during the program that brought you close to violating the maximum drawdown rule?

Esther: When I first received my funded account (challenge account) from RebelsFunding like most new traders, I didn’t comprehend the daily drawdown rule. New traders, especially those transitioning from retail to prop firms most often forget that the daily drawdown rule applies to them 100%.

We are used to trading our own capital, so when we draw up trading plans and goals, we do not take this factor into consideration. Secondly, like most traders, I wanted to pass the challenge in the nick of time. With no pressure, I wanted to make over 1% daily, and this caused me to use big lots and make big mistakes.

Interviewer: Could you share some details about the small, sensible steps you took to guide your program toward success?

Esther: As traders, we sometimes forget our originality, who we are, and the pairs we trade. The first thing I did was to sincerely ask myself, “How much profit can you generate?” The second thing was to begin to appreciate small wins. In the trading community, especially in prop trading, there is always news of big wins. But a win is a win, regardless of the amount. This is what guided me.

I stopped looking at capital gains and instead looked at win rate. Every time I took a trade, I put my ability to make my $1 profit without touching my daily drawdown. I stayed true to my one pair, one session, and one time frame.

I developed my own system, and what other traders did wasn’t my business. I am a unique person, and so that became my watchword.

Interviewer: Tell us more about how you managed to turn around from a significant loss to fulfilling the program’s requirements without resorting to risky or speculative trades.

Esther: I stand by the philosophy that a win is a win. The first goal when you lose a significant amount of money is to divide it into small chunks. There is the temptation to begin revenge trading and attack the market; that was the last thing on my mind.

The first thing is to realize it isn’t the market’s fault; it’s your fault, and to take accountability for whatever loss. The second is to go back to your drawing board, find your wins and your losses, and make sure to replicate your wins.

Capitalizing on your wins will help you make more. Repeating the same good decisions you’ve made as a trader is key.

Interviewer: What strategies or trading techniques do you primarily use to make your trading decisions?

Esther: Unfortunately, I do not have a trading strategy. I just stick to one session and one trading pair. I have noticed that sticking to and mastering one session and one pair (be it currency, indices, metals, exotics, or minors) helps you concentrate more as a trader.

When I began, like most traders, I wanted to be here for it all (Sydney, Tokyo, London, and New York). But now I know my session. If I come and I see $1, I take it and go home. In trading, knowing when to go home is very important. It prevents you from overtrading.

Also, I stick to one time frame. Some traders move from H4 to W1, which I feel doesn’t really help. Know your candles, study them, and know your entries and exist points. It’s very important that your charts are the same so you don’t get confused.

Interviewer: Risk management is crucial in trading. How did you approach risk management when trading the challenge account?

Esther: Like most new traders who transition, there is a tendency to forget that the daily drawdown isn’t a joke and should be taken seriously. The rule of thumb is not to risk what you can’t lose. Our daily drawdown is 5%.

First, consider your ability to make a profit. I make 0.5–1%. So I divide that into a sizeable chunk; if I lose 0.3%, it’s time to close for the day. So I can recover the next day and, like I previously said, know when to go home.

RebelsFunding gives you unlimited trading days; that’s enough to tell you it’s time to go home and come back stronger the next day.

Always make your trading plan by looking at your daily drawdown.

Interviewer: Collaboration with RebelsFunding must be exciting. Could you elaborate on how their support and guidance contributed to your success?

Esther: I would like to thank the entire Support team at RebelsFunding. They were there for me for every question, every inquiry, and every complaint. I always say the best way to know a firm’s intentions towards you is how you’re treated by their support team.

Having someone believe in you and your small abilities as a human drives you to do better. (I think this is one of the best prop firms in Nigeria I know).

Interviewer: Education is ongoing in trading. How do you stay updated with market trends and continuously improve your skills?

Esther: I keep the Forex Factory blog open. The first thing I do when I wake up is check USD-pair-related news (I only trade XAU/USD).

I also check AMA and DXY for the currency pair I trade. It makes it easier for me to read. My articles are smaller and easier to comprehend, and I do not get conflicting information.

I also make sure to steer clear of online gurus and focus on only one expert. In the long run, getting education from quacks will end up giving you false hope and false direction.

Interviewer: Trading psychology can play a big role in success. How do you maintain discipline and control your emotions while making trading decisions?

Esther: When I first began, like most traders, I looked first to the internet for traders before me, and that, I will say, affected my psychology. The minute I cleared that off, I was able to think straight.

I always remind myself, as a trader, about where I come from. We have a popular saying in Nigeria that says, “Having a big eye will be the end of you.”

As a trader, it is important to avoid greed trading, know your strengths and weaknesses. I, for instance, do well with small lots and small profits.

When you, as a trader, begin to deviate from who you are, you begin to create room for fear.

Fear is what ends the trading journey. Fear makes it impossible for you as a trader to make the right decision about what trades to save and what to let go, when to layer, and when to double-sell.

I have the saying that small lots will hold and small losses will be recovered.

Interviewer: Are there any specific trading tools or resources that you find particularly valuable in your trading journey?

Esther: I recently started using Forex Factory. I use RF-Trader. I use the Killzone indicator on TradingView. It helps me backtest the day before by showing every session’s Higher highs and Lower lows.

I am a scalper, and it’s important for me to know my zones so as to know when to exit a trade if it begins to break those zones.

Interviewer: What are the features you like about the RF-Trader platform, and why?

Esther: The One-click feature is a miracle! I am a scalper, so I open 2-3 positions; one click enables me to open them at the exact same place I want them open, and I have the ability to lock Stop Loss, Trailing Stop Loss, and Profit.

I don’t need to leave charts when trading because my trades will close on their own. You can monitor risk and profit. It’s important to know how much money you’re making or losing from a trade.

Interviewer: Finally, what advice do you have for fellow traders who are presently in the evaluation stage?

Esther: Take deep breaths; it’s very important that as a trader, you breathe in and out. Secondly, back-test to know your strengths. Our strengths are different; I can scalp, and someone else can day trade. I can do XAU/USD, and someone else can do GBP/JPY, USD/CAD, USD/CHF, or EUR/CAD.

Thirdly, there is no rush—absolutely none. With RebelsFunding, you have unlimited trading days; take all the time you want. I did too.

Fourthly, contentment is key. Learn to leave the market once you see profits. Cut your losses.

Fifthly, understand that the pace at which you grow isn’t the same as others, and that is valid and okay.

Finally, always remember that your losses don’t define you.

Interviewer: Thank you. Thank you for your time and the experience you’ve shared. More wins to you!