How to Trade the Break & Retest

The break and retest strategy involves identifying key levels, waiting for a breakout, and then strategically entering the market during the retest phase.

Today, we will cover the key steps that can help you identify it, how to trade it and it’s advantages:

Key steps for break and retest identification

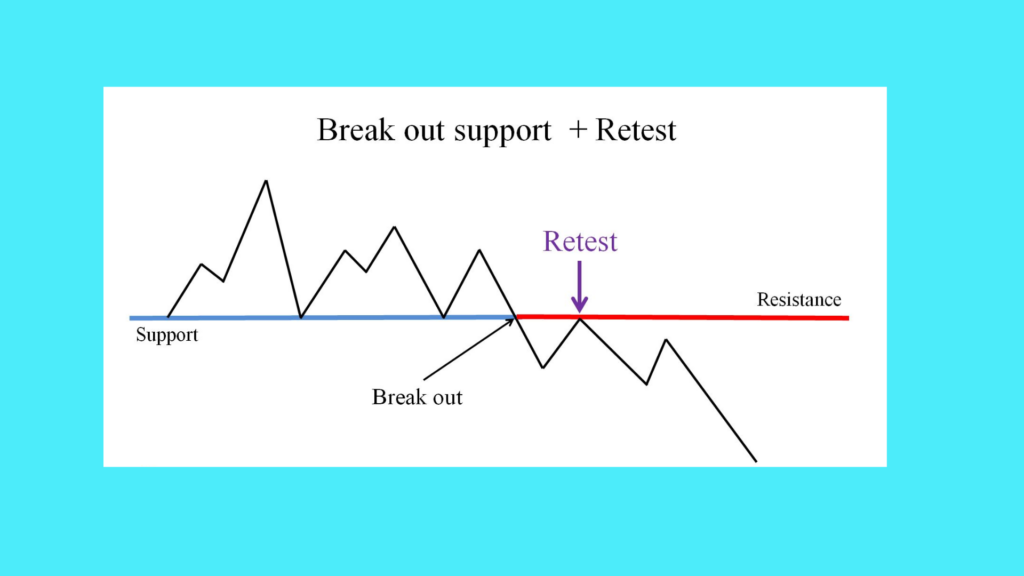

1. Breakout: Here, price action clearly and convincingly breaches a significant support or resistance level with a strong surge in trading volume (signifying a shift in market sentiment).

2. Retest (or Hook): After the breakout, price retraces to retest the same level (the broken level). The retest often confirms the level’s significance.

3. Reversal: You want to look for a collective signal from price action suggesting the broken level is now acting as new support (bullish breakout) or resistance (bearish breakout).

For confirmation & to gain confidence:

(i) confirm that the breakout aligns with the prevailing trend

(ii) lower volume on the retest compared to the breakout suggests the new level is holding, and high volume on the breakout signifies strength

(iii) utilise other technical analysis tools, and confirmation candlestick patterns like pin bars or engulfing bars at the retest level

(iv) wait for the candle at the retest to close (look for a clear close above/below the broken level before entering a trade).

To successfully trade the break and retest strategy (in addition to the above points), you want to:

1. Identify well-defined support and resistance levels. These zones become potential breakout areas.

2. Look for “swift” retests. Prolonged retests can be a sign of market indecision.

3. After confirmation, you may consider entering your trade around a buffer zone based on your risk tolerance, and volatility.

(During bearish markets, look for breakouts below support levels that have been retested.

If the price fails to overcome this new resistance (retest level) and continues down, it strengthens the bearish signal.

You can speculate that the price will most likely go downwards (after a retest and confirmation).

And in a bullish market or uptrend, identify breakouts above support levels that are then retested).

4. Calculatedly place your stop-loss orders. Also, set realistic price targets based on your trading strategy & risk management plan.

Advantages of the break and retest strategy

1. A retest can act as a confirmation that the breakout is genuine and not a false breakout. It can help you filter or weed out trades that might lead to losses.

2. It is versatile. This strategy can be applied in various market conditions (both trending and ranging). It can also be used across different asset classes.

3. It is simple to learn. Compared to some complex trading strategies, this trading concept may be easier to grasp for beginners.

4. It can improve your entry timing. Waiting for the retest can help you potentially enter trades at a more favourable price.

In conclusion, the break and retest methodology can be an effective tool for you if you’re aiming to spot high-probability trading opportunities.