15 Single Candlestick Patterns you Should Know

A single candlestick pattern shows price (or trading) activity within a period of time.

It is identifiable by its unique shape, colour & wick, and indicates a bullish, bearish or neutral trend.

Let’s look at fifteen (15) single candlestick patterns and what they usually signify in the market:

1. Doji candle

It is called a doji when the opening and exit prices are almost the same. It is a thin line with a plus-shaped look.

They signal indecision or struggle between buyers and sellers.

Here, neither of the two market participants are able to gain control and the consequence is a draw.

2. Dragonfly Doji

This formation is one with no real body and a long downward shadow. It is often located when an instrument’s open, close, and high prices are identical.

In this situation, we should know there’s struggle between market speculators and expect a possible trend deviation.

3. Long-Legged Doji

It is a candle with a long upper and lower shadows/wicks with the Doji in its middle. It has almost the same opening & closing price.

4. Gravestone Doji

A gravestone doji is a bearish reversal candlestick. It is formed when the open, low, and closing prices are all at the same level or very near each other (with a long upper wick).

Its presence is most significant when it appears after an uptrend, preceded by bullish candlesticks.

It tells us that the uptrend may be coming to an end.

5. Morning Star

Morning star is made up of three candlesticks: first is a tall black candle, next is a smaller black or white one with a short body & long wicks in the middle, and third, a tall white candle.

The middle candle usually represents a moment of market indecision where buyers overpower sellers.

The third candle confirms the reversal and can mark a potential new uptrend.

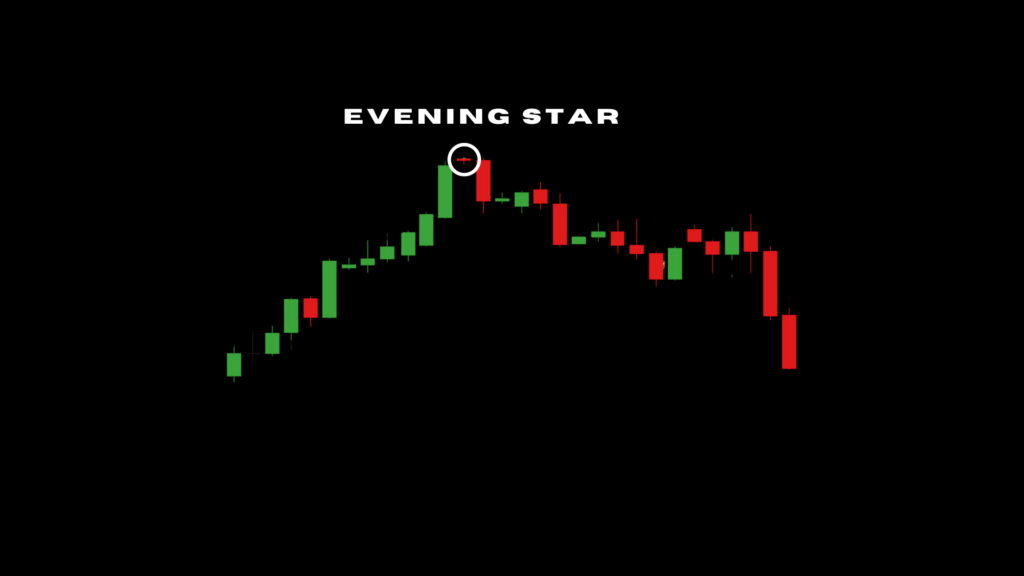

6. Evening Star

Also a three-candle structure: The first one is bullish, followed by a Doji or spinning top, and a bearish candle next.

The Evening Star is a crucial indicator of a bearish reversal. It is the opposite of the morning star.

7. Shooting Star

This bearish reversal formation resembles the inverted hammer. It occurs in an uptrend.

Its shape indicates that the price opened at its low, rallied, but pulled back to the bottom.

We see buyers try to push price up, but sellers come in & dominate them.

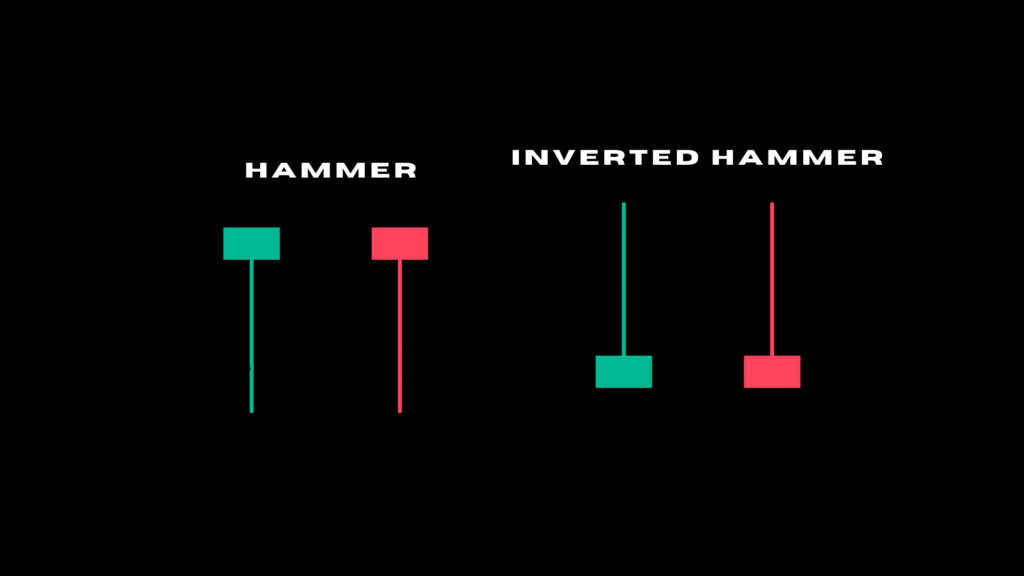

8. Inverted Hammer

Inverted hammer looks like a real life hammer turned upside-down.

With a long top tail and a small body at the bottom, it gives a cue of the market shooting up.

9. Hammer

This one is a bullish reversal sign often seen during a downtrend. It has a small upper body with a long lower wick.

When the price is going down, hammers hint us that the bottom is near & the price will very likely start to rise again.

10. Hanging Man

The Hanging Man looks exactly like Hammer, but it has a different meaning. It often appears at the top of an uptrend, signalling a likely bearish reversal.

It warns traders of possible market shifts.

11. Marubozu

In Japanese, the word “marubozu ” means “bald head or shaved head”. Thus, we can say that this candle is a “bald candle” — One with no (or very little) shadow/wick from the body.

We find it when the opening & closing prices of an asset are equal or very close to each other.

Expect a potential continuation if a white or green Marubozu forms at the end of an uptrend.

And a reversal may take place if we identify it at the end of a downtrend.

When a black/red Marubozu occurs at the end of a downtrend, we expect a potential continuation.

And when spotted at the end of an uptrend, it denotes a reversal.

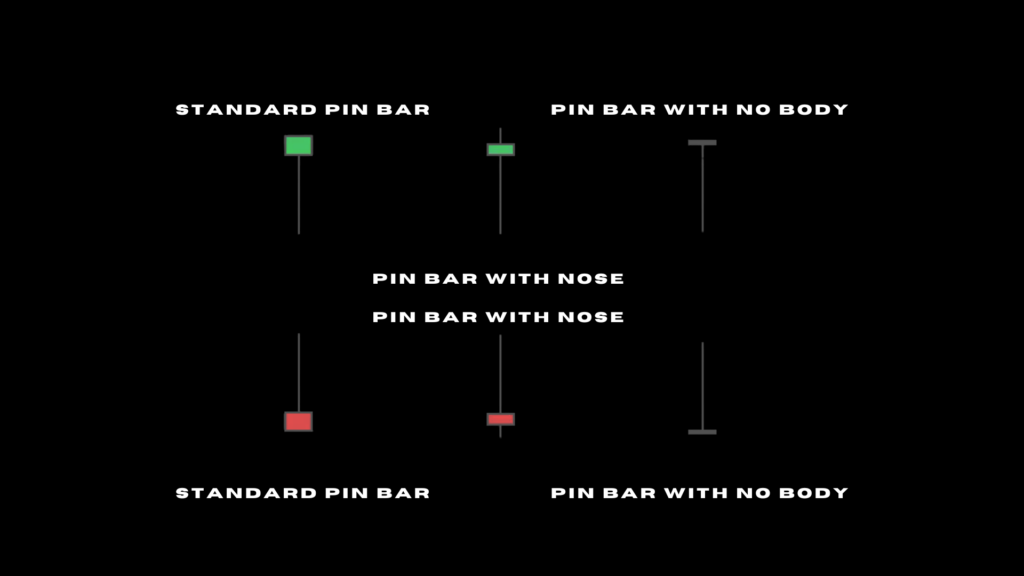

12. Pin Bar

Also known as Pinocchio, pin bar is identified by a long wick or tail and a small body.

This candlestick mostly hints at a reversal, but it can also signify a continuation.

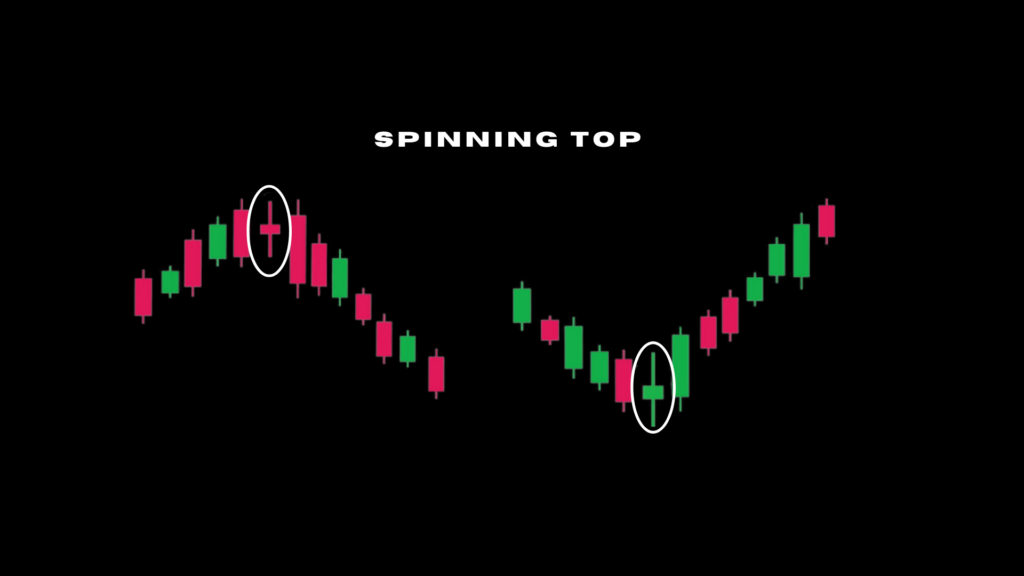

13. Spinning Top

It has a short real body that’s vertically centred between long upper and lower shadows.

Often times, it implies market indecision, a power struggle between buyers and sellers.

14. Bullish Harami

(Harami in Japanese means “conception or pregnant”).

Generally, it has two candlesticks. The initial candle is a large candle, and the second is a small one.

The body of the second is contained within the body of the first candle.

First candlestick is seen as the mother with a large real body that completely embodies the smaller second candlestick in front (which gives the subtle picture of a pregnant mother).

A bullish harami is considered a reversal formation that happens after a downtrend.

15. Belt-Hold Lines

A prominent trend reversal indicator used in technical trading. Belt-hold lines is made of two candlesticks that form during a solid uptrend or downtrend.

The bullish belt hold surfaces in a downtrend and consists of a long bearish candlestick followed by a shorter bullish one.

It opens at the low of the previous one, with no lower shadow.

On the other hand, the bearish belt hold is seen in an uptrend. It opens at the high of the previous candlestick and has no upper shadow.

As always, these formations should not be used in isolation for market prediction.

Single candlestick patterns are most productive when combined with other technical analysis (or confirmation) tools.